Fraud and insider threats are a risk to all businesses, whether it is payments fraud, online fraud, or insider bad actors. The threat landscape is more complex than ever before and the number of stakeholders who need to coordinate is extensive. According to a recent Gartner report the Fraud Leader needs to coordinate across eight stakeholder groups: Identity & Access Management (IAM), Infrastructure & Cyber Security, Customer Experience, Fraud Analysts & Data Scientists, Finance, Growth & Marketing, Customer Support and, Legal and Compliance. Coordination across all these departments is key to keeping the threats at bay.

“Orchestration of multiple different vendor solutions or capabilities is increasingly necessary to implement an effective end-to-end fraud management strategy.” Gartner Market Guide to Online Fraud Detection, 13 May 2020

From internal threat detection, user behavior analytics, access management, transaction monitoring, etc. there is a lot going on across all the processes across the complete attack surface. Firms have invested in a lot of best of breed technologies across the landscape, but find difficulty is in pulling the disparate data sets from different domains together into a coherent visualization of the real world for the analyst.

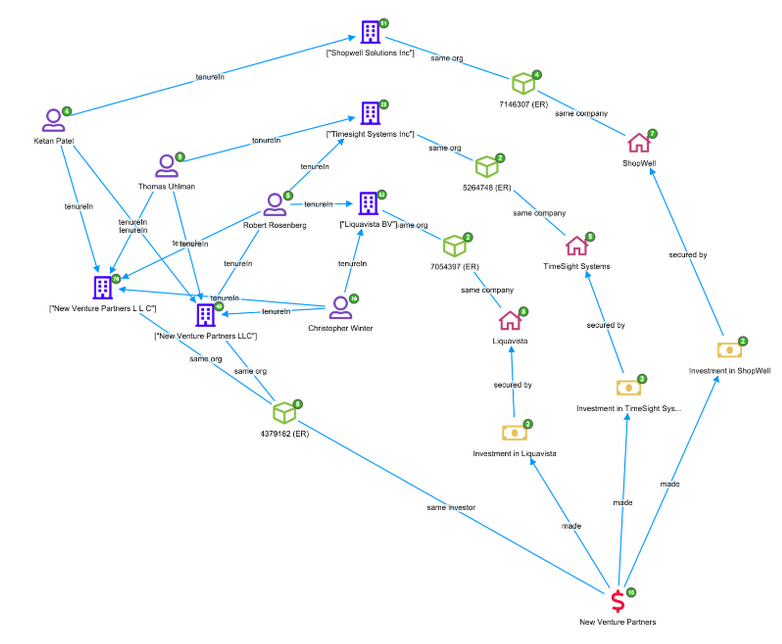

This is what Siren does for the fraud analyst. Pulling all the data together from multiple domains to get the full picture driven by search, BI, knowledge graph, and alerting. Also aided with strong AI capabilities in Entity Resolution, NLP, and Machine Learning, Siren helps derive meaningful insights from the data, analyzing massive data volumes in real time.

What if it was possible to build a real-time knowledge graph of threats as they emerge across all domains (cyber, human behavior, physical security, etc.)? And then once you have that picture, having the ability to run advanced analytics on top of disparate data sets that were never designed to go together? Gaining true insights across all domains that would not be possible otherwise?

That’s the power of Siren’s search-based investigative intelligence in the world of fraud and insider threat. Linking best of breed capabilities with the power and visualization and analytic capabilities of the Siren Knowledge Graph.

Siren holds a rich set of integrated capabilities leveraging Elasticsearch that can seamlessly integrate into any organizations’ framework. The intuitive user interface provides a rapid time-to-value for a fraud analyst.

Siren has been used in the Fraud & Insider threat use cases including:

Our experts can show you exactly how to leverage your data to uncover powerful insights!

Get a detailed and thorough understanding of the Siren Platform