How To Detect Financial Crime with Siren AI + Siren Fraud 360

Summary

Davide, PhD, Data Scientist at Siren, demonstrates how Siren’s advanced analytics platform helps financial economic crime teams uncover illicit transaction networks. The Siren platform combines powerful graph analytics, entity resolution capabilities, and AI-driven reporting to identify suspicious patterns and relationships hidden within massive transaction datasets. By integrating multiple data sources into a comprehensive “Fraud 360” view, financial institutions can effectively monitor and investigate potentially fraudulent activities that would otherwise remain concealed among millions of legitimate transactions.

Challenge

Financial institutions process millions of transactions daily, creating an enormous challenge for fraud detection teams. Traditional detection systems often fail to identify sophisticated fraud networks where criminals:

- Use multiple accounts and identities to obscure connections

- Create slight variations in personal information to avoid matching algorithms

- Distribute transactions across different accounts and geographic locations

- Perform transactions that individually appear legitimate but collectively form suspicious patterns

Without advanced tools, analysts must manually sift through overwhelming amounts of data, making it virtually impossible to connect related transactions and identify coordinated fraud networks before significant damage occurs. Financial crime teams need solutions that can quickly narrow focus to the most suspicious activities while revealing hidden relationships between seemingly unrelated accounts.

Solution Implementation

Siren’s approach to financial crime detection integrates several advanced technologies into a comprehensive workflow:

Data Integration with Fraud 360: Siren creates a holistic view connecting fraud detection results, financial transactions, accounts, customer information, and account analytics. This 360-degree perspective ensures analysts can see connections across all relevant data sources simultaneously.

Multi-layered Filtering: Starting with millions of transactions, analysts apply progressive filters:

- First, filtering by high-risk transaction status

- Then, selecting accounts flagged with critical risk levels

- Further narrowing by transaction amount, focusing on high-value transfers

- Finally, identifying geographical anomalies through visualization

Entity Resolution: Siren’s AI detects when customers attempt to use the same or similar contact information (email, phone numbers, addresses) across different accounts, linking these entities despite variations in how information is entered.

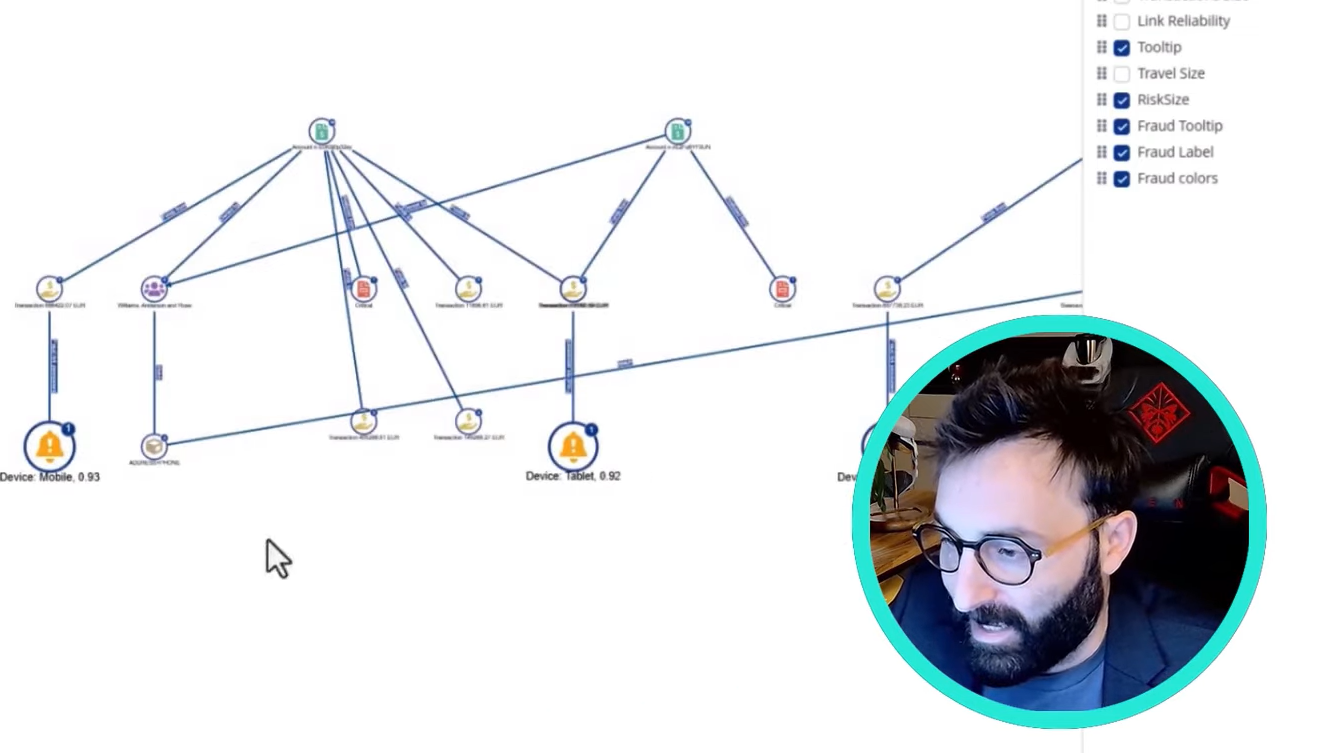

Graph Analytics: Using Siren’s patented “Common Communicators” algorithm, analysts can discover hidden connections between seemingly unrelated transactions and accounts. This visualization reveals networks that would be impossible to detect through traditional analysis.

AI-Generated Reporting: Siren’s custom-trained LLM functions as a financial crime analyst, automatically generating comprehensive reports that summarize findings, highlight suspicious patterns, and provide recommendations for further investigation.

“From 10 million transactions to identifying a sophisticated fraud network in minutes – Siren AI transforms financial crime detection”

Results and Metrics

The demonstration showcased impressive results when applying Siren’s approach:

- Massive Data Reduction: Starting with 10 million transactions, filtering rapidly narrowed to 25,000 high-risk transactions from critical-status accounts

- Precision Targeting: Further refinement identified 5,000 high-value transactions, then focused on just the top 50 by amount

- Geographical Insight: Visual analysis revealed an unusual cluster of 12 high-risk, high-value transactions in Saudi Arabia

- Network Detection: Graph analysis uncovered that two seemingly separate customers (Williams and Swanson) shared the same address and phone number while conducting suspicious transactions through different accounts

- Comprehensive Documentation: The AI-generated report provided a detailed summary of findings, high-risk indicators, unusual geolocation patterns, and recommendations for further investigation

This process demonstrated how Siren can transform what would traditionally be weeks of investigation into a focused analysis completed in minutes, while uncovering connections that might never have been found through conventional methods.

Conclusions

Siren’s integrated approach to financial crime detection represents a significant advancement in the fight against increasingly sophisticated fraud networks. By combining multiple analytical techniques—filtering, visualization, graph analysis, entity resolution, and AI—Siren enables financial institutions to:

- Dramatically reduce investigation time from weeks to minutes

- Uncover hidden relationships that would be impossible to detect manually

- Process and analyze millions of transactions with unprecedented efficiency

- Generate comprehensive reports that document findings for regulatory and legal purposes

- Stay ahead of evolving criminal tactics through advanced pattern recognition

For financial economic crime teams facing ever-growing transaction volumes and increasingly complex fraud schemes, Siren provides the tools needed to identify and disrupt illicit networks before significant damage occurs. The platform’s ability to rapidly narrow focus to the most suspicious activities while revealing hidden connections makes it an essential solution for modern financial crime detection.