Retail banks are working with Siren on the challenges facing their SME portfolio managers. Faced with commercial relationships that are too numerous for personal attention but too diverse for standardized treatment, they need intelligent support to get insight on emerging risks. Risk management based on models of historic experience are blind to new threats, such as Brexit; currently a great unknown. But with Investigative Intelligence, banks can equip their experts with the information they need in real time.

Uncovering indirect impacts of Brexit through payment flows

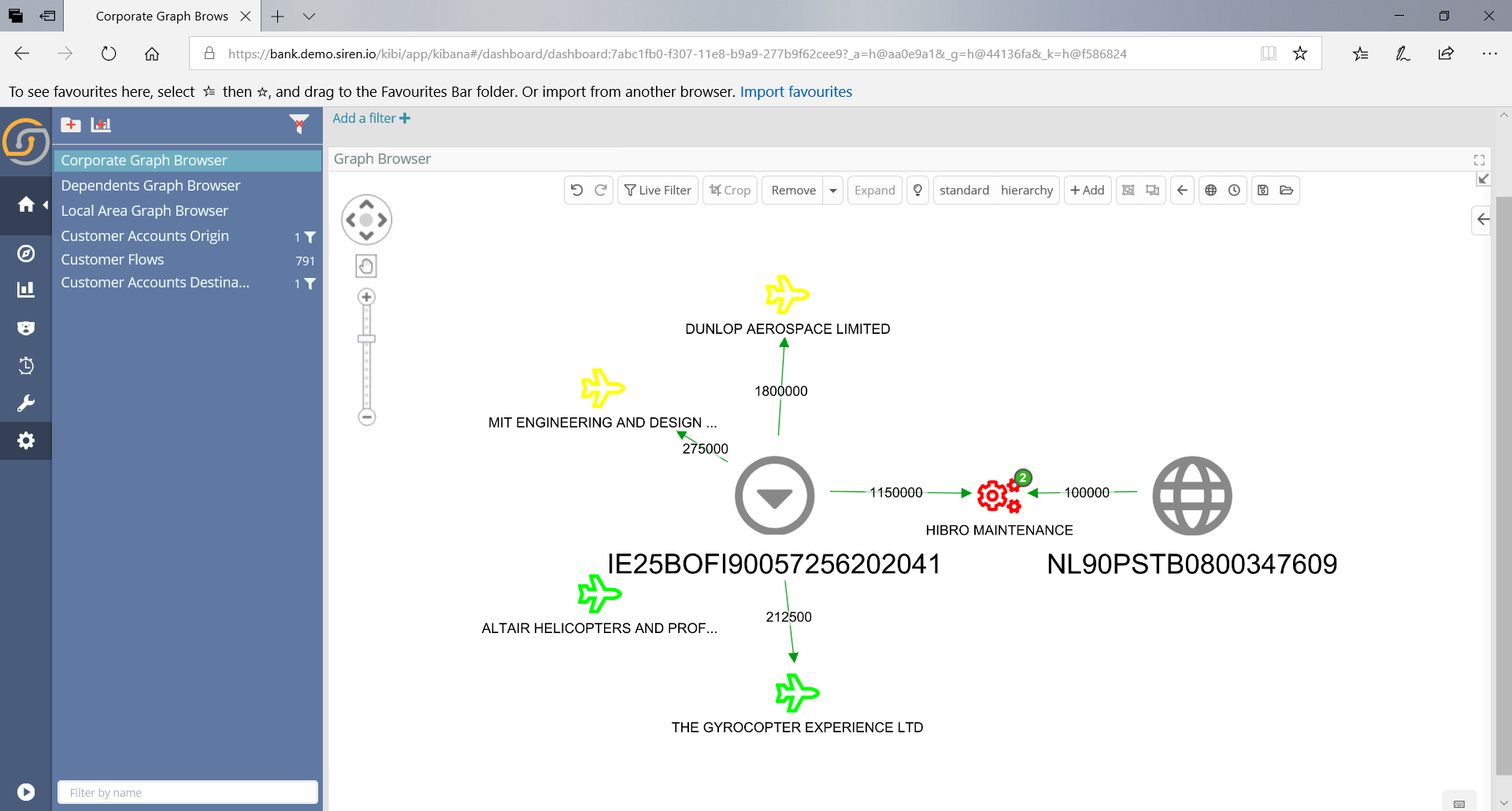

Every large corporation affected by Brexit is embedded in an ecosystem of SMEs supporting its operations. The corporation might be able to plan its way through Brexit (e.g. relocating operations), but SMEs could be devastated. Can SME portfolio managers find these indirect Brexit exposures and bring their expertise to bear in the right places?

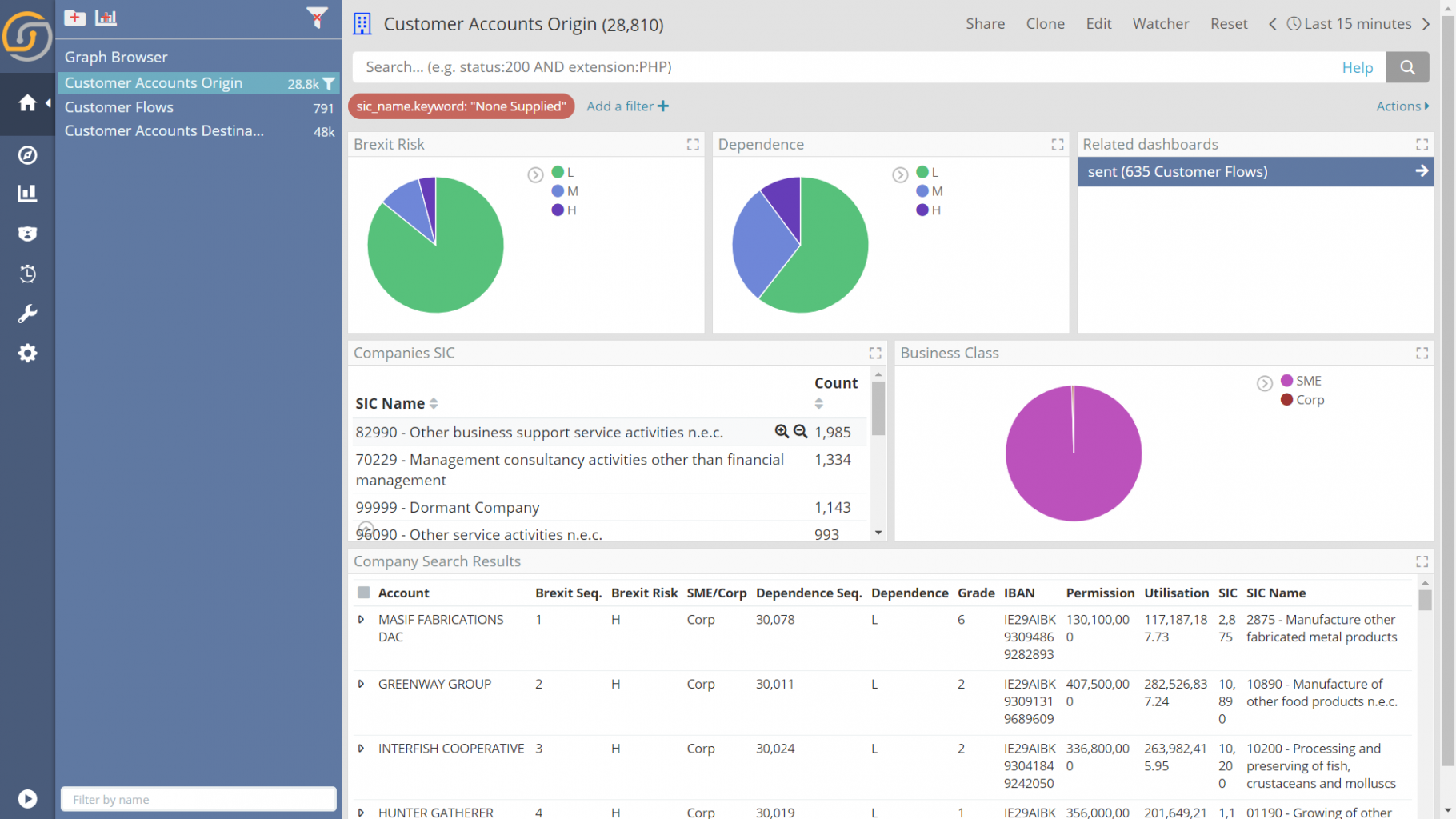

A client dashboard that incorporates both visualizations and tables of the relevant payments and customer data is a good place to start. Brexit risk can be derived from standard industry classification (from company registration or internal data). More importantly for SMEs, which can be highly dependent on a few customers, the level of dependence on third parties can be assessed from quantitative assessment of payment flows.

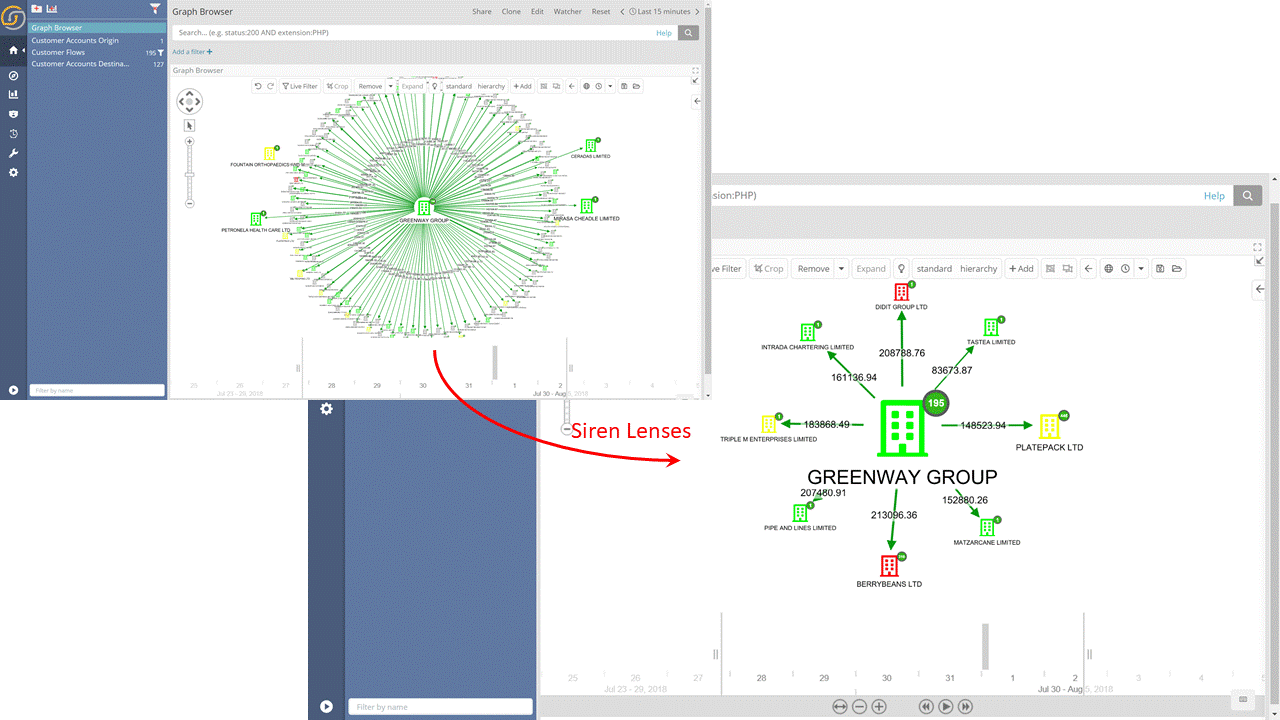

Looking at a simulated company (Greenway Group), payment flows show the many companies that supply its operations. Siren’s knowledge graph lenses focus attention on those with the greatest dependence on Greenway; the subjects for investigation.

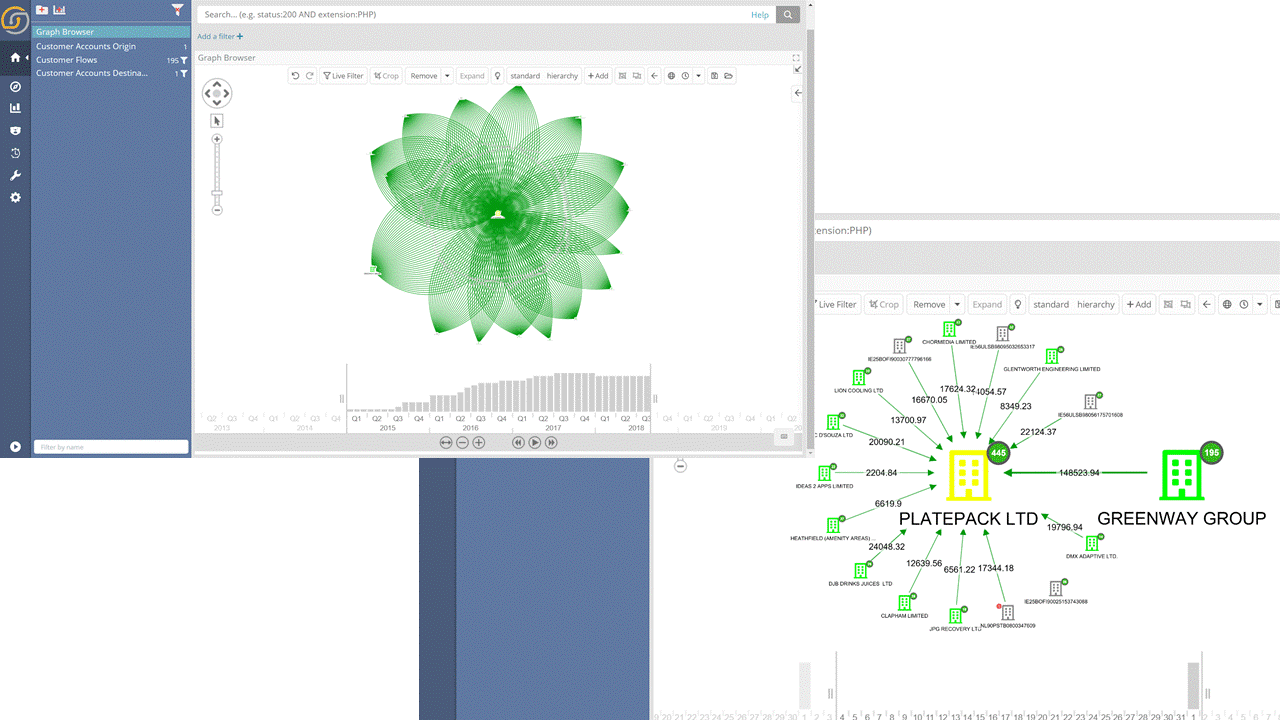

One of these simulated customer SMEs (BerryBeans) is highlighted in red (showing a high dependence), so we can look at its income flows more closely. The timeline of flows shows an expected seasonality, but with income from other customers falling off over time. Knowledge graph capabilities enable the investigator to consider flows overall, or in animation across a time series. The image shows an end-state where almost all income is now from the same source:

Now the SME portfolio manager has a focus for his expertise and can consider what can reasonably be done, such as planning support the customer would need if Greenway were to move overseas, or considering the value of security held for BerryBeans in a post-Brexit world.

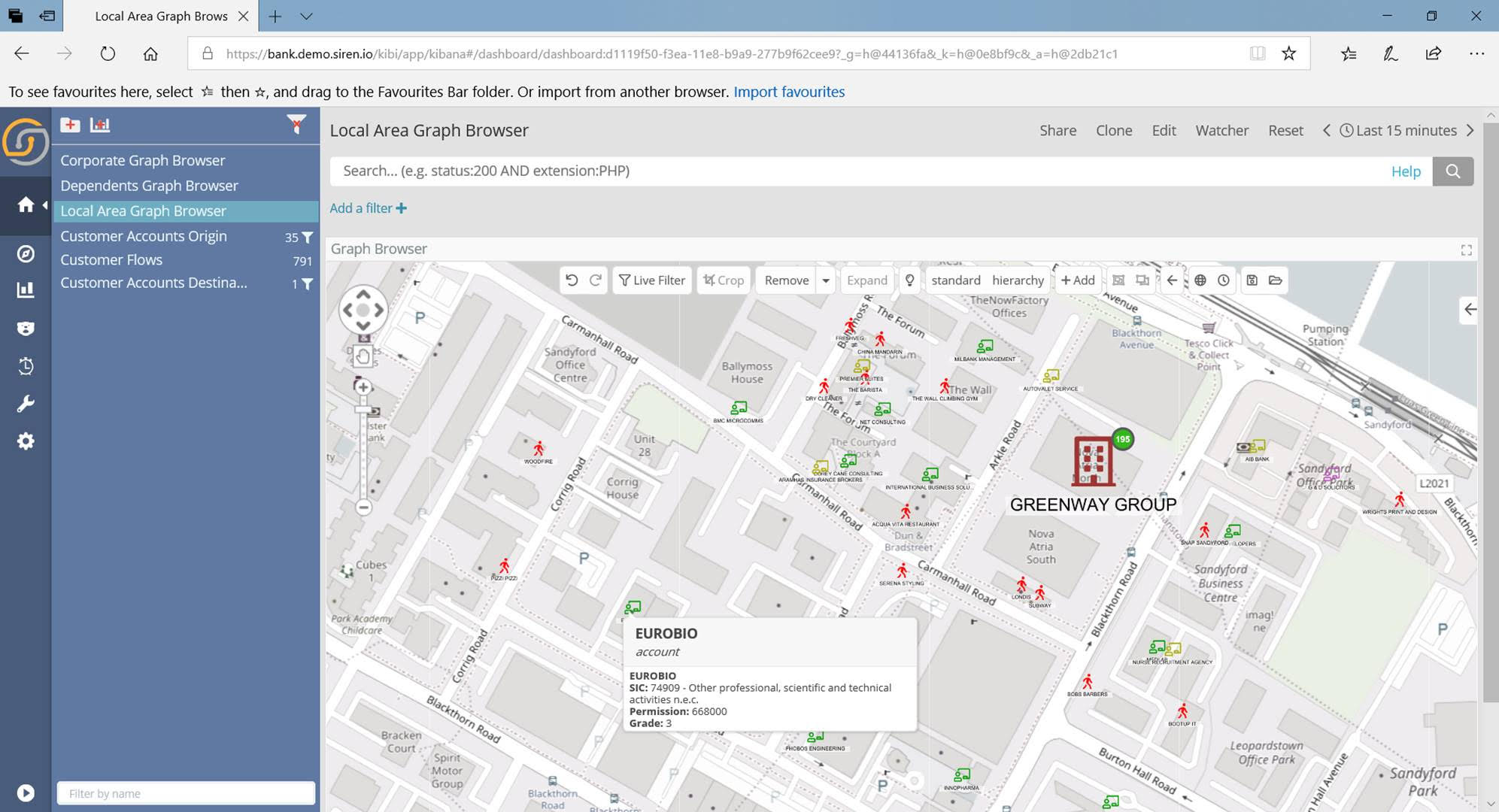

Everything is local- The impact of location on Brexit risk

Not all dependencies can be revealed through payment flows. Some SME businesses in particular are highly dependent on local footfall; convenience retailers, hairdressers, dry cleaners, gyms, restaurants and cafes. This is a mapping challenge: to highlight your SME customers that may be depending on a corporate presence to generate that footfall. Location data, as seen below, is the ideal way to asses such risks.

In other cases, the apparent dependence will be more remote; a customer may be very dependent on income flows from a customer of another institution, in which case understanding others that share the same source of funds could be instructive.

How Siren 10.1 addresses the concentration risk challenge in a different way

Siren brings together all manner of diverse data on SMEs, from drill down into to “systems of record” to text notes from face-to-face interviews. But the most vital role for Investigative Intelligence is to show where to apply the SME portfolio manager’s expertise and understanding of commercial reality. Statistical models from data science can be used to make predictions on future events based on historical data in a steady state. But for unexpected challenges like Brexit, personal understanding and expert judgment are crucial.

Investigative Intelligence helps business bankers to understand the impact of a wide range of unexpected events. Brexit is only one example. Others, including major weather events, corporate failures, impact of regulatory changes, online competition, or even internal reorganization of the SME portfolios, are best understood if experts can focus their skill and knowledge where it is best applied.

If you want to better understand the potential impact of Brexit on your business, then let’s talk.