Fraud, insider threats and risk are huge issues for corporations globally. Many corporates are struggling with the scale of the fraud, risk and threat dynamic internally. They are standing up teams to act as an internal policing service for these threats. The trend is for cyber threat, fraud, financial crime and internal risk to come under a single operating unit to manage these corporate level risks. These units are now struggling to find a single unified platform to manage all the challenges they have in front of them.

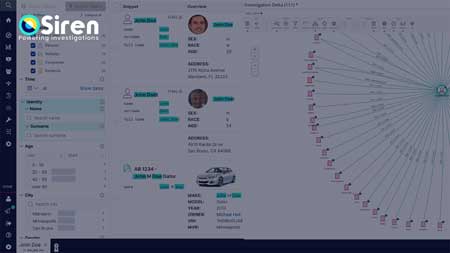

Siren has worked with a range of large corporations in Banking, Insurance, Retail, Big Tech, Large Corporates and Consulting to root out fraudulent activities internally and externally. Siren’s ability to rapidly onboard structured and unstructured data, process data with Entity Resolution and NLP and provide Graph Algorithms out of the box all contribute rapidly.

A top 20 European Bank, which operates across multiple countries, was struggling with cyber, financial crime, fraud and internal threat investigations. The team was using mostly manual file investigation based tools to try to investigate problem areas for the Bank.

With Siren we are able to unify all investigations – historic cyber breaches, financial crime, internal fraud, HR issues and leadership threats. We have not found that scale, scope and flexibility without massive effort in any other tool on the market.

Our smartest customers get 70% of their time back so they can focus on their missions instead of battling with “swivel chair” searches.